Tax season is a time-sensitive matter you want to save time on. That’s why we’ve created this guide to help you create Tax Invoice Template Australia quickly and easily. In this article, we’ll explain what an invoice is, why you might need to create one and outline the benefits of doing so. We’ll also show you how to create an Tax Invoice Template Australia specific templates and resources and provide tips for preparing and sending them out. So be sure to read on for all the details on creating effective tax invoices!

What is an invoice?

An invoice is a document that displays the details of a sale or transaction. It confirms the particulars of a sale or transaction and can help to improve your cash flow.

An invoice is an important tool in financial management because it shows buyers what they purchased and helps sellers track their sales figures. Invoices also play an important role in tax planning as they provide documentation for income tax purposes. Finally, invoices are often used to request payments from customers.

Tax Invoice Template Australia can be created in various formats, including electronic, paper, and PDF files. Most businesses use electronic invoicing software to automate their billing process and keep track of customer payments. This software allows you to create custom templates that make billing faster and easier while reducing data entry errors. Billing software also offers features like automated notifications sent out when payments are due, which saves time during the later stages of processing transactions.

Why create an invoice?

The primary purpose of an invoice is to provide a transaction record. An invoice details the products or services provided, as well as the charges for those products or services. This information can help you track your business transactions and ensure accuracy in billing. In addition, invoice templates can streamline your business transactions by providing common layouts and formats across different businesses.

When creating an invoice, it is important to keep in mind the following points:

1) The type of document that will be generated – Electronic invoices are typically more efficient than paper-based invoices because they reduce time spent on administrative tasks such as filing and tracking bills. However, if you create a paper-based invoice, follow proper printing guidelines so that your documents look professional.

2) The date range covered – Your invoices should always cover the most recent month (or quarter if applicable) unless otherwise specified.

3) Billing terms – You may want to establish specific terms for receiving payments, including terms like same-day payment processing or immediate credit approval.

4) Currency – When specifying which currency an order was placed in, use either euros/USD/GBP, etc… If no currency is given, then USD will be assumed.

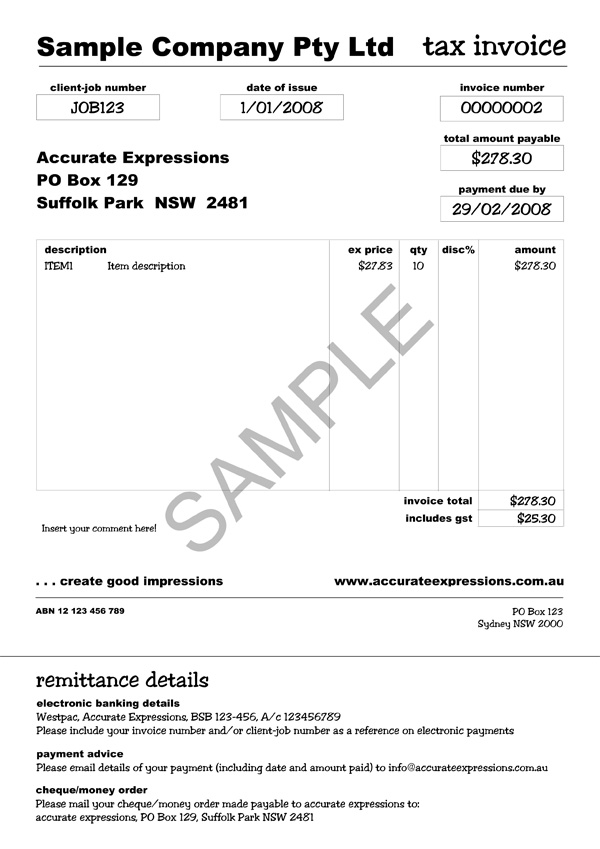

Issuing tax invoices | Australian Taxation Office tax invoice template Australia

Invoice Sample Australia – Australian Tax Invoice tax invoice template Australia

10+ Tax Invoice Templates Download Free Documents in Word, PDF tax invoice template Australia

Australian Taxation Office tax invoice template Australia

Invoice Template Australia Free Download

Australian Tax Invoice tax invoice template

Online Invoices tax invoice template Australia

Sample Australia Tax Invoice tax invoice template

Sample Invoice Template Australia Custom Myob tax invoice template Australia

Advantages of creating an invoice.

There are several reasons why creating an invoice can be beneficial for your business.

- It helps you manage and keep track of your finances. By systematically tracking expenses, you can better understand where your money is going and make informed financial decisions.

- Invoices are usually received favorably by creditors. A well-made invoice will help reduce the time it takes to collect customer payments, which could lead to increased revenue and profits down the line.

- Creating an invoice can improve customer relationships because customers will feel more trustful when they know their obligations towards you as a business owner. Decreased need for communication regarding outstanding debts or warrants.

Part 2

How to create an invoice in Australia

Creating an invoice in Australia can seem daunting at first, but with the help of this guide, it will be much easier. This article provides a step-by-step guide that covers everything from determining which bills to include on the invoice to formatting and layout options.

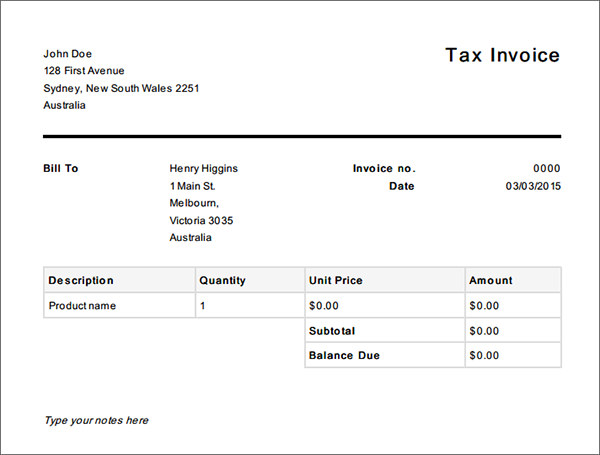

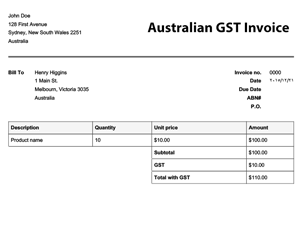

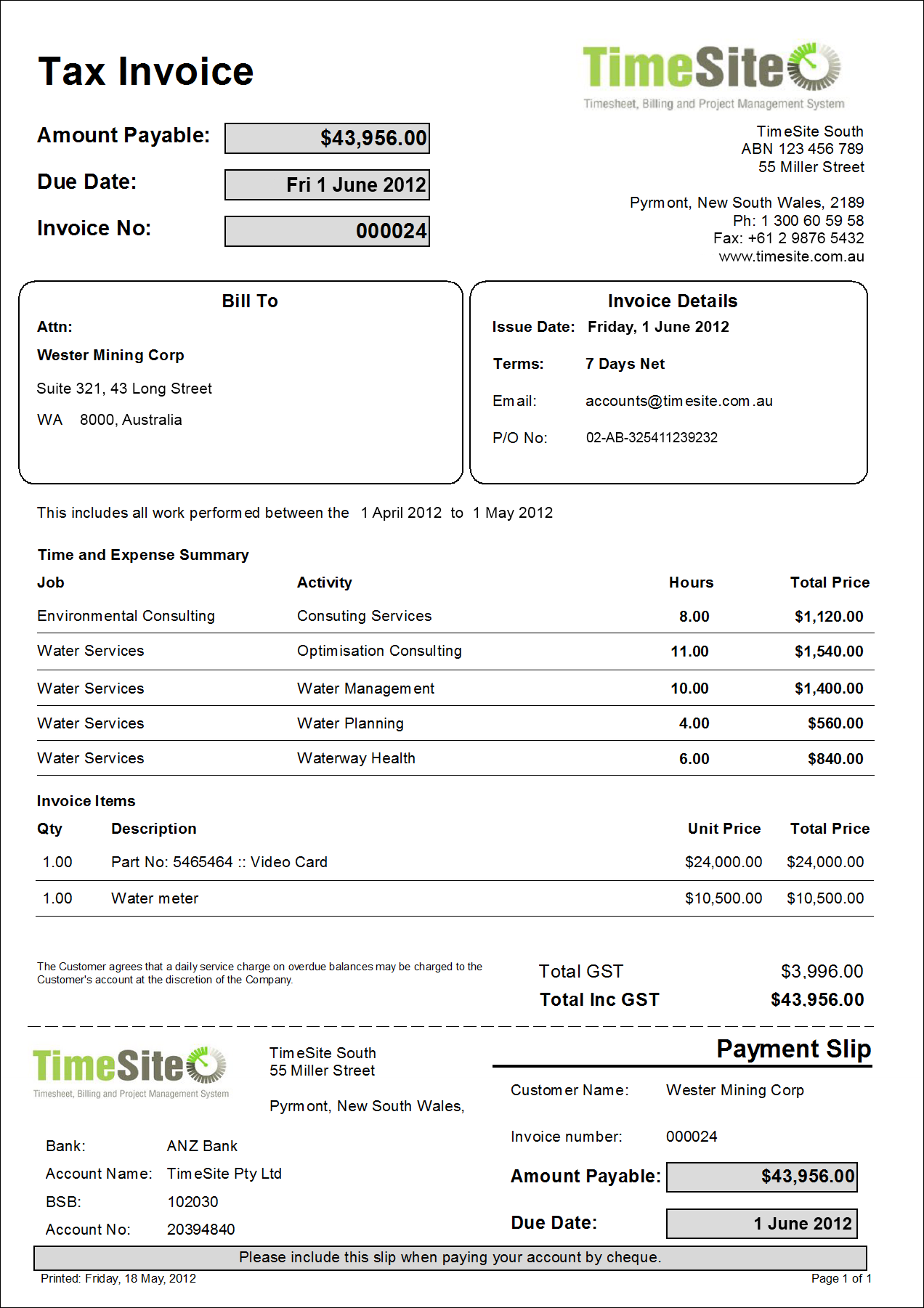

First and foremost, you need to decide what type of bill you would like to create your invoice. It could be for services rendered, such as software licenses or internet usage fees, or for products purchased, such as software or hardware items. Once you have determined the type of bill, look through all the other elements typically included on an Australian invoice, such as customer name(s), address(es), date/time, etc., and determine which ones best suit your particular situation.

Once you have created a list of the required information and determined its format (e.g., text file versus PDF), begin creating your document by adding in any introductory remarks about who is responsible for paying what amount, along with contact details if applicable. Next comes the section where you outline each itemized charge, including unit price, tax inclusive amount(s) if applicable, the total amount due, and any discounts/credits given at this time (if applicable). The final sections pertain to payment procedures – either by cheque/draft drawn on designated bank account numbers OR online via accepted credit card platforms -and any notes regarding late payments or refunds should also appear here.

Preparing and sending your invoices

Preparing and sending your invoices is a very important part of your business. It’s the first step in establishing good relations with your clients and showing them that you appreciate their business. Here are a few things you need to do to prepare and send your invoices:

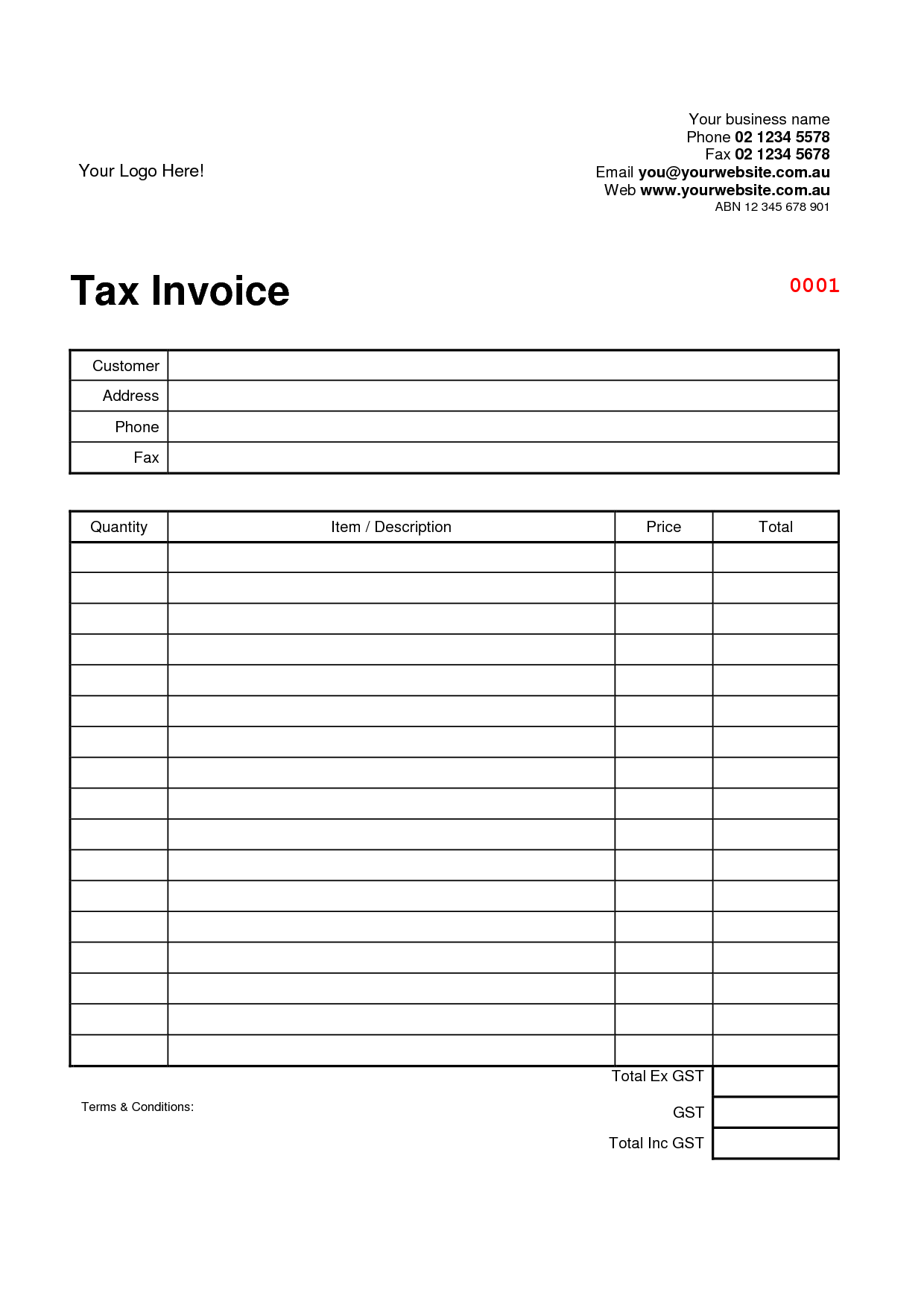

- Choose an invoice template best suits your company’s needs. There are many different types of templates available, so it’s important to find one that will fit both the look and feel of your business and the contents of your invoices.

- Input the correct tax rates into each invoice for yourself and your employees using Australia tax tables. This ensures that you remain compliant with Australian taxation laws while still charging what is fair for the services provided.

- Make sure that all your invoice content looks professional – including fonts, layout, headings, etc. You want to ensure that every aspect of each invoice reflects positively upon you as a business.

- Send out regular invoices throughout the year anticipating client payments. This will help keep relationships positive by ensuring timely payment (hopefully fewer late payments).

Conclusion

If you’re an Australian business or plan on starting one soon, you must understand invoice creation and management basics. By following the steps in this blog post, you’ll be well on becoming compliant with Australian tax laws. Thank you for reading!