Hey there! If you’re in the UK and have a business, you’ve heard of HMRC. It stands for Her Majesty’s Revenue and Customs, and they’re the folks who handle taxes. One big thing they care about is how you make your invoices. Today, we’re talking about special forms called HMRC Invoice Templates that come in PDF and Excel files. These make doing your taxes way easier!

What is an HMRC Invoice Template?

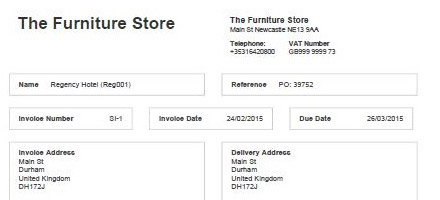

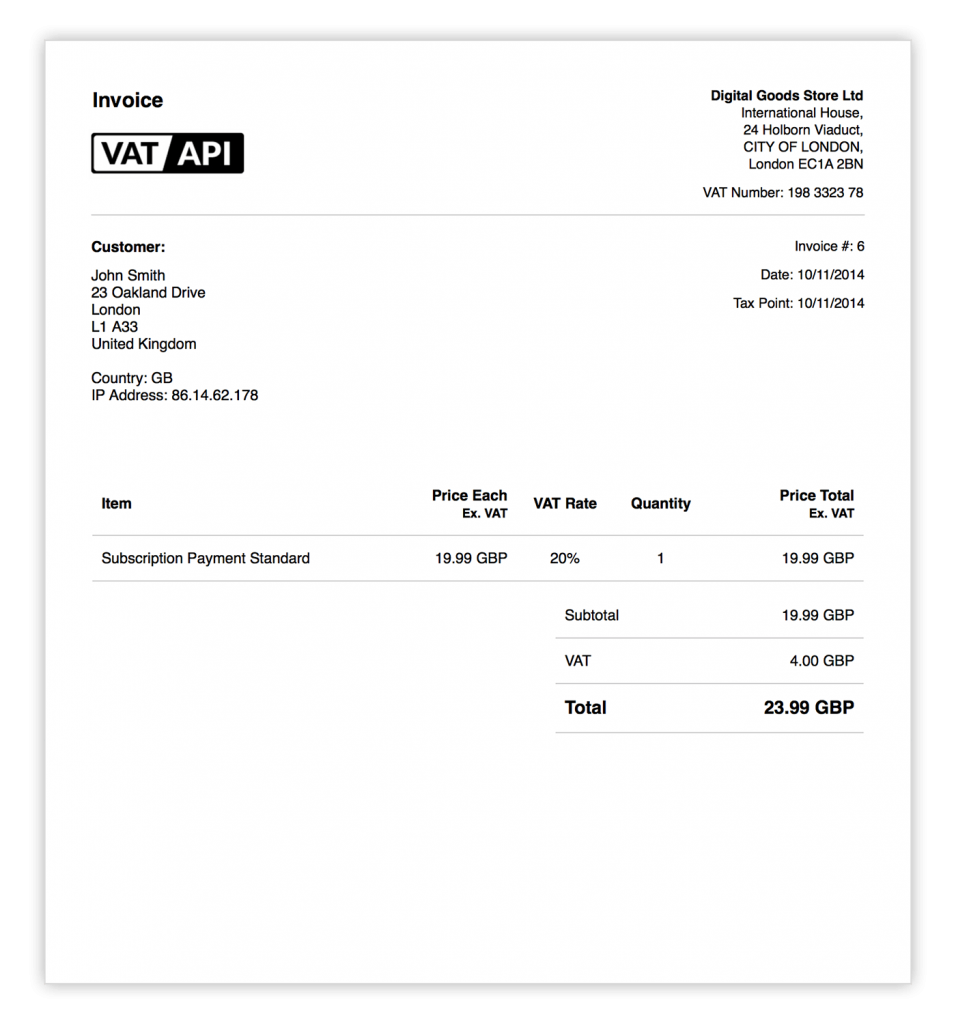

An HMRC Invoice Template is like a cheat sheet for making invoices that HMRC will like. It helps you put all the right info in all the right places. It is super important because HMRC has rules about what needs to be on an invoice.

PDF vs. Excel – Which is Better?

You might wonder, “Should I use a PDF or an Excel file?” Both have their good points!

So, you’re scratching your head, wondering, “Should I go with a PDF or an Excel file for my HMRC Invoice Template?” Don’t worry; both have awesome features. Let’s dive in!

PDF: Simple and Reliable

Easy to Share

Once you make a PDF, sending it is a breeze. Just attach it to an email, and off it goes to your customer.

Looks the Same Everywhere

The cool thing about PDFs is that they look the same no matter where you open them. That means no surprises or messed-up layouts.

No Accidental Changes

With a PDF, what you see is what you get. Nobody can accidentally change the numbers or text, which can be a big plus.

Excel: The Math Whiz

Automatic Calculations

Excel is like a math genius that works for you. Just put in a formula, and it does all the hard math stuff instantly.

Easy to Update

Got a last-minute change? No problem! Excel lets you update numbers or text super quickly, and it even updates all the math for you.

Customizable

Excel is like a playground for people who love to organize. You can sort, filter, and arrange data however you like.

Choose what works best for you!

Must-Have Parts of an HMRC Invoice Template

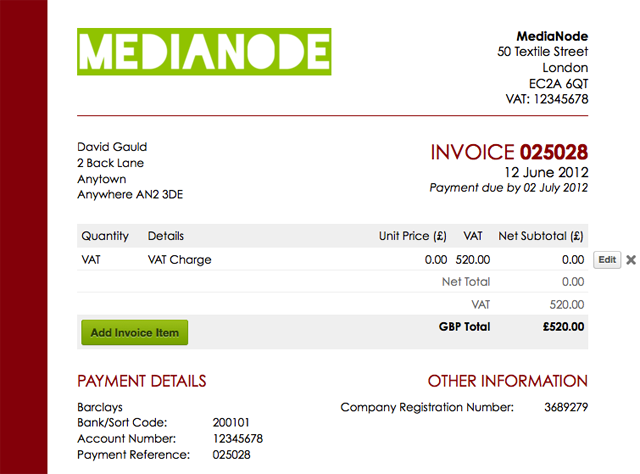

Your HMRC Invoice Template needs to have some key things:

- Your business name and contact info.

- Customer’s name and details.

- A list of what you’re billing for.

- How and when do you want to get paid?

- Any tax stuff you have to show.

How to Use a PDF Invoice Template

Using a PDF version is pretty simple:

- Download the PDF template.

- Fill in the blanks with your info.

- Save it and send it to your customer.

How to Use an Excel Invoice Template

Excel is also easy but has extra cool stuff:

- Download the Excel template.

- Type in your info.

- Excel can do the math for you!

- Save and send it just like the PDF.

Oops! Mistakes to Dodge

Be careful not to make these common goofs:

Not Putting All the Info

Make sure you include all the important stuff. Please include details to avoid problems later.

Typing Errors

Double-check your work. If you type something wrong, it could be clear to your customer and even cause legal issues.

Forgetting to Save a Copy

Always, always save a copy for yourself. It helps you keep track of what you’ve done and is super important for your records.

Why Use These Special Templates?

Using an HMRC Invoice Template is super helpful:

Saves You Time

No need to start from scratch. Just open the template, fill it out, and you’re done. Easy-peasy!

Makes You Look Professional

When you use a special template, it shows you know what you’re doing. People like that and trust you more.

Keeps You on the Right Side of the Law

HMRC has rules about what should be on an invoice. These templates make sure you remember everything important.

Conclusion

Making sure you have the right kind of invoice is a big deal if you’re in the UK. It helps you with HMRC and makes your business life easier. So, whether you pick PDF or Excel, using an HMRC Invoice Template is a smart move!

FAQs

What is an HMRC Invoice?

An HMRC Invoice is a special form that helps you make invoices the way HMRC likes them. It’s super useful if you have a business in the UK.

Are These Templates Free?

Yes, you can find many free HMRC Invoice Templates online. Some websites let you download them without paying a penny!

Do I Have to Use HMRC Invoice Templates?

If you’re in the UK, it’s a good idea to use them. They help you follow the rules for what needs to be on an invoice.

PDF or Excel: Which is Better?

Both are good but for different reasons. PDFs look the same on every computer, while Excel files can do math for you.

What If I Make a Mistake on My Invoice?

If you make a mistake, it’s best to make a new invoice. Remember to mark the old one as “canceled” and the new one as “revised.”

How Do I Make Sure My Invoice is HMRC-Compliant?

Use an HMRC Invoice Template and make sure you fill in all the needed info. It includes things like your business name, what you’re billing for, and any tax details.

Can I Add My Logo to the Invoice Template?

Yes, most templates let you add a logo. It’s a great way to make your invoice look more professional.

Do I Need Special Software to Use These Templates?

Nope! You need a program that can open PDFs or Excel files. Most computers already have these.

Where Can I Find These Templates?

You can find HMRC Invoice Templates on websites that offer business forms. Just search for “HMRC Invoice Template,” and you’ll find plenty of options.

Can I Save a Copy of My Filled-Out Invoice?

Yes, and you should! Always keep a copy for your records. It’s important for when you do your taxes.