Invoice Payment Method Example: Understanding payment choices for more suitable cash flow & customer satisfaction As a business owner, it’s important to understand the different invoice payment plans and their respective pros and cons.

The right invoice payment method can improve your business’s cash flow, improve buyer happiness, and decrease the risk of fraud. This article will explore the most popular invoice payment method example and their key pros and cons.

Invoice Payment Method Example

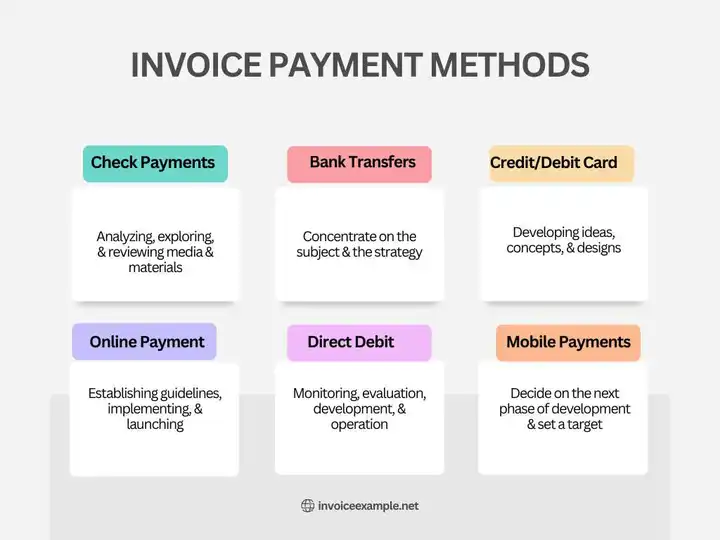

Some common invoice payment method examples include:

Check Payments

It is a simple payment method that has been around for decades. With this option, the customer writes a check for the invoice amount and sends it to the recipient. This method is often used by individuals and small businesses that prefer a more traditional payment approach.

Pros:

- Familiar with many customers

- No need for online access

- Lower risk of fraud compared to online payment methods

Cons:

- Slower processing time compared to other methods

- Can be lost or stolen in the mail

- May incur bank processing fees

Bank Transfers

Direct Payment from Customer to Recipient A bank transfers funds directly from the client’s bank account to the recipient’s. This can be done through online banking or a wire transfer and is often used by businesses and individuals who want to avoid the fees associated with other payment methods.

Pros:

- Faster processing time compared to checks

- No need for a payment processor

- Lower transaction fees compared to online payment methods

Cons:

- Requires access to online banking

- It may require a wire transfer fee

- Higher risk of fraud compared to other methods

Credit/Debit Card Payments

The funds are transferred directly from the client’s bank account to the recipient’s. Credit cards are becoming increasingly popular for businesses as they demonstrate modernity and build client trust.

Pros:

- Increased client satisfaction

- Quick and secure payment processing

- Demonstrates that your business is up-to-date

Cons:

- Higher costs compared to other methods

- Risk of fraud and charge-backs

Online Payment Services

Fast, Convenient, and Secure Online payment services, such as PayPal and Venmo, provide a convenient way for clients to complete payments online. These services are quick and safe and offer added features to manage invoices and payments more effectively.

Pros:

- Fast, convenient, and secure payment processing

- Offers tools and features to manage invoices and payments

- No need for a payment processor

Cons:

- Higher transaction fees compared to other methods

- Risk of fraud and charge-backs

Direct Debit

Automated Payment for Recurring Invoices Direct debit is an automatic payment method in which the customer authorizes the recipient to debit their bank account for the invoice amount. This is often used for recurring payments, such as utility bills or subscription services.

Pros:

- Automated payment process

- Ideal for recurring invoices

- No need for manual payments

Cons:

- It can be difficult to cancel or change

- Risk of fraud and errors

Mobile Invoice Payments

Mobile invoice payment authorizes customers to quickly and easily pay invoices from their mobile devices, resulting in faster payment times and increased convenience.

Mobile payment apps offer similar benefits, completing it more comfortable for companies to receive payments on the go.

Modern Invoice Payment Methods

The benefits of modern methods are:

- Speed and Efficiency: One of the main advantages of payment methods is speed.

- Increased Security: On the other hand, modern invoice payment methods have enhanced security features that reduce the risk of fraud and errors, giving business owners peace of mind.

- Better Record Keeping: Improved record keeping compared to traditional payment methods. This completes it more comfortable for company owners to keep track of their finances, ensuring accuracy and reducing the risk of errors.

- Convenience: They can make payments from anywhere, anytime, using their smartphones, tablets, or computers. This eliminates the need for clients to physically visit a bank or other financial institution, saving them time and making the payment process more convenient.

Choosing the Best Invoice Payment Method for Your Business

When selecting a method, it’s essential to consider the following factors:

- Cost: come with different costs. Be sure to consider the fees involved and select a method that suggests the best value for your company.

- Customer Preference: Regard the methods most commonly used by your clients and choose a suitable method.

- Security: it is safe and keeps your and your client’s sensitive financial information.

- Integration with Accounting Software: it can easily integrate with your accounting software to streamline your financial management process.

How important is the availability of different payment options for clients in terms of client satisfaction?

It is very important for client satisfaction. Clients want the convenience and flexibility to choose a method that performs best for them, whether a traditional method like a check or a more modern option like online payment services. Offering various payment options shows that a business values its client’s requirements and is willing to go the additional mile to deliver a positive payment experience.

Read Also: How to Invoice Payment Process: Tips and Tricks

When customers can select a method they are comfortable with and trust, it can increase their confidence in the company and help build a strong relationship. On the other hand, limiting payment options can lead to dissatisfaction and may even drive customers away.

Additionally, offering various payment options can attract new customers and improve a business’s overall reach and success. This is especially important in today’s global economy, where businesses need to accommodate customers from different countries and regions, each with their preferred payment methods.

How does the globalization of business impact the choice of invoice payment methods companies use?

Globalization has greatly impacted the choice of invoice payment methods companies use, as businesses today must be able to accommodate customers and partners from different countries and regions, each with their preferred payment methods.

In the past, businesses were limited to traditional payment methods, such as checks and bank transfers, which often needed to be faster and more expensive to process, especially for international transactions. However, with the growth of e-commerce and the increasing use of digital payment methods, businesses today have a wider range of options to choose from, making it easier to conduct global transactions.

For example, online payment services like PayPal and Stripe allow businesses to easily receive payments from customers anywhere in the world using a variety of currencies. Mobile payment apps and digital wallets are also becoming increasingly popular, offering fast and secure payment options accessible from anywhere.

However, the globalization of business also presents new challenges and risks, such as currency exchange rates, cross-border fees, and differing regulations and payment standards. To mitigate these risks, businesses must choose secure, cost-effective, and compliant payment methods that comply with the laws and regulations of the countries they operate in.

How does the use of automated invoicing and payment systems impact the efficiency of the payment process?

The use of automated invoicing and payment systems can greatly improve the efficiency of the payment process. Here are some ways in which automation can The use of automated invoicing, and payment systems can significantly impact the efficiency of the payment process in several ways:

- Streamlined invoicing: Automated invoicing systems allow businesses to generate and send invoices quickly and easily without requiring manual processes. It can save time and reduce the risk of errors.

- Improved accuracy: Automated systems can ensure that invoices are accurate and consistent and include all the necessary information. It can reduce the need for manual checking and improve the overall accuracy of the invoicing process.

- Faster payments: With automated payment systems, customers can easily make payments online or through a mobile app, reducing the time it takes for payments to be processed. It can help to improve cash flow and reduce the number of overdue invoices.

- Better record-keeping: Automated systems can automatically record and store information about invoices and payments, providing businesses with a complete and up-to-date record of their financial transactions. It can be particularly useful for accounting and tax purposes.

Conclusion

In conclusion, choosing the right invoice payment method example can significantly impact your business’s cash flow and financial management. With the variety of modern invoice payment methods available, it’s important to consider factors such as cost, customer preference, security, and integration with accounting software when making your decision.

Implementing the right payment method can help you save time, reduce the risk of fraud and errors, and improve the overall efficiency of your financial management process.