Are you Looking to take advantage of great payment terms? Check out our blog for more information on net 30 day payment terms! These terms allow you to pay your bills within 30 days, saving you a lot of money. We explore the benefits and consequences of these terms and offer tips for taking advantage of them. Don’t miss out – check it out today!

What are net 30 day payment terms?

Net 30 day payment terms are a great way to get your business off the ground. They offer customers convenience and certainty: you will receive payment by the end of the month, regardless of whether or not there is money in your account. And since processing costs can be expensive, 30 days end of month payment terms can also help save on those costs.

30 day payment terms wording go beyond just payments; they also encompass all other aspects of your relationship with a customer. For example, if an order ships late, you’re already covered – so there’s no need to worry about getting charged for shipping again later on. If something goes wrong with an order after it’s been shipped, you have easy access to support resources so that everything can be resolved as quickly as possible. In short, net 30 day payment terms provide peace of mind and total control for both sides – which is why so many businesses now embrace them.

How do they work

When a business offers net 30 day payment terms, customers can pay in installments for thirty days. This allows businesses to receive payments more frequently and strengthens customer and business relationships.

The main advantage of this arrangement for businesses is that it allows them to receive payments more frequently. Receiving payments regularly helps reduce cash flow issues and maintains liquidity levels.

Additionally, by providing longer payment terms than traditional credit or debit cards allow, businesses have an opportunity to build trust with their customers. Trust is key in any relationship, as it creates positive expectations on both sides of the transaction. When these expectations are met, customers are much less likely to switch providers or complain publicly about poor service experiences.

Another reason net net 30 payment schedule benefit businesses is that they help them focus on long-term goals rather than short-term concerns. By gradually building up debt over time instead of all at once, companies can save money while still meeting their immediate financial needs.

In addition, offering shorter-term installment plans gives consumers greater flexibility when purchasing decisions; they no longer feel beholden to one specific plan because installment plans typically offer fewer restrictions than credit card purchases.

Consequently, by following these three simple tips – offering long Payment Terms (net 30 days), creating flexible repayment options (including installments), and communicating clearly about your policies – you’re sure to increase sales and boost customer satisfaction.

Best tips for net 30 day payment terms

Many businesses prefer the convenience of net 30 day terms when making a payment. This payment schedule is perfect for companies that want their customers to have ample time to pay them back but still need the borrowed money repaid as soon as possible.

Following these best tips for net 30 day payment terms will help your business succeed when it comes to receiving payments.

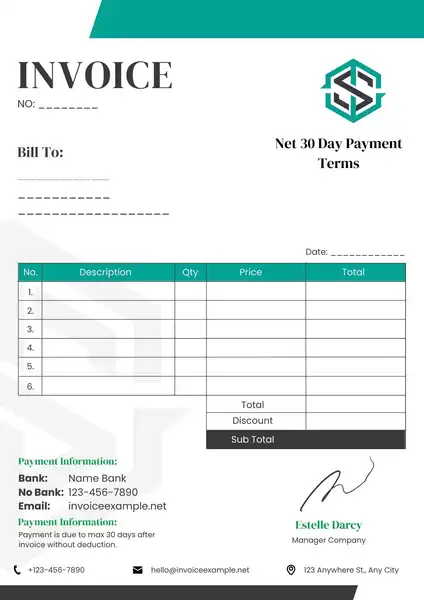

- communicate your payment terms: Make sure all stakeholders know your preferred payment timeline and any exceptions or modifications. Everyone must understand what’s expected, so there are no surprises down the road.

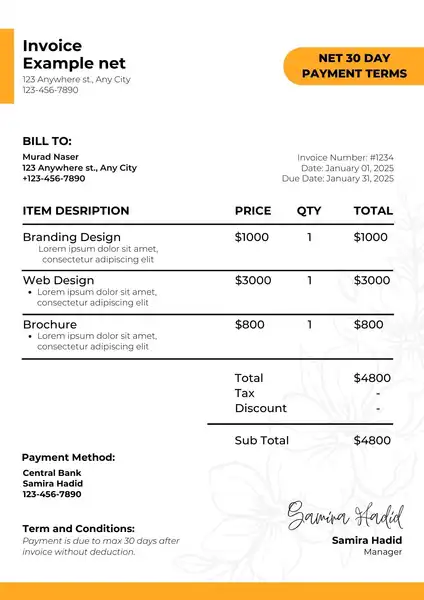

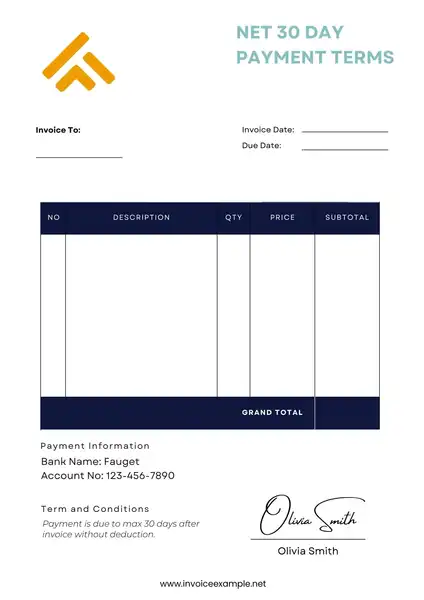

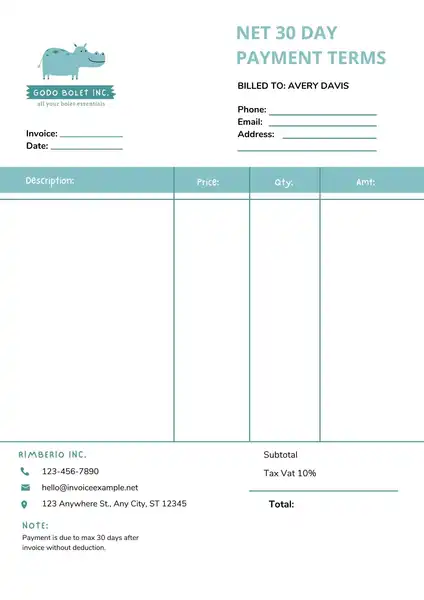

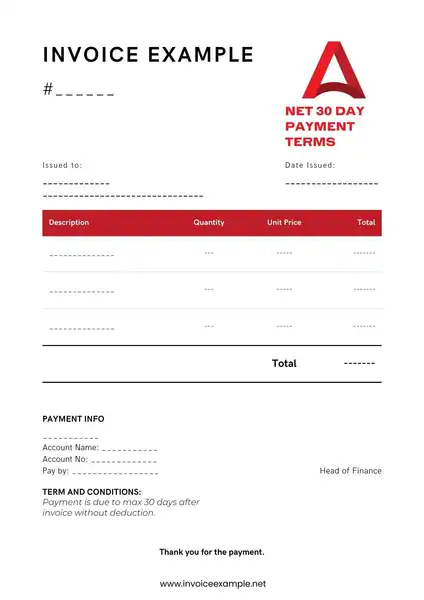

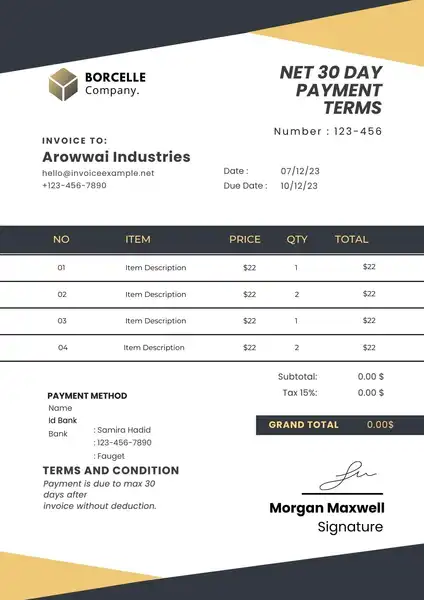

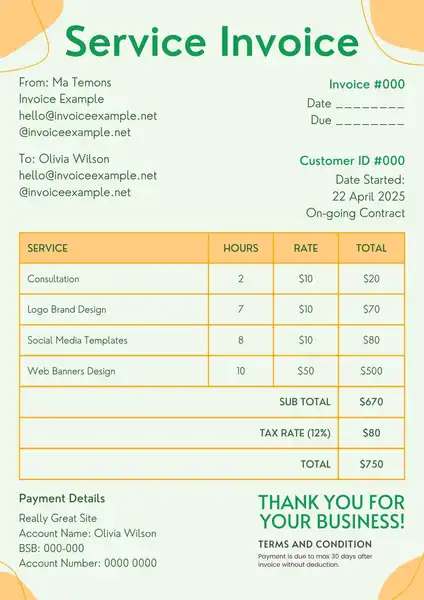

- Keep accurate records: Keep track of receipts, invoices, customer files, and other pertinent information related to payments to provide a clear picture of past transactions and future obligations. Having this data at hand will make tracking payments much easier.

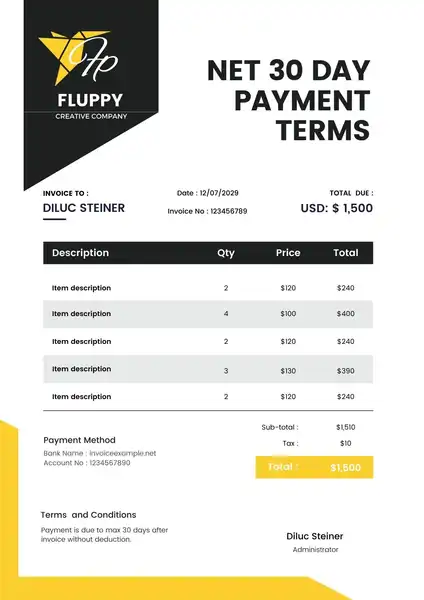

- Send timely invoices: Invoice promptly so that customers know exactly how much money you require upfront to avoid late payments or additional fees incurred due to delayed repayments. By sending an invoice regularly, you can ensure that customers always have up-to-date information about your financial situation and don’t feel taken advantage of by not paying on time.

- Follow up on late payments: Not only should you send follow-up emails after receivability deadlines pass but also contact delinquent customers.

Why are net 30 day payment terms important?

- It provides a sense of security for clients by ensuring they can always pay their bills on time.

- Clients appreciate knowing there is no need to worry about late fees or other penalties if they don’t pay their bills on time.

- It shows appreciation for businesses that can provide this payment schedule and helps maintain good customer relationships over time.

- Paying your bills regularly can help you avoid debt accumulation and improve your credit score.

- By checking off one more item from your “to-do” list, you will free up more resources to invest in acquiring new business or expanding current operations

How do you take advantage of net 30 day payment terms?

- Net 30 day payment terms are becoming more and more popular in the real estate industry. They allow buyers and sellers to make a deal without worrying about payments until after the property is sold or rented. There are several benefits for both sides of the equation:

- Buyers benefit from shorter waiting periods between closings, which can reduce their stress levels during the buying process. Furthermore, they no longer need to wait until months after closing before they can take possession of their new home or apartment.

- Sellers enjoy increased liquidity by quickly selling their properties and receiving payment sooner than if they were on a traditional timeline with monthly payments. Additionally, net 30-day terms give them peace of mind knowing that any potential buyer will have fully researched their property before making an offer.

Disadvantages of net 30 day payment terms

When it comes to buying or selling a home, many people prefer shorter payment terms. However, there are some disadvantages associated with this choice. Here are five of the most common:

- Less flexibility – A buyer who wants to borrow money against their home has less flexibility than someone buying without borrowing constraints. If you want to buy a house in three months and your bank won’t approve a loan for more than 30 days, you’re out of luck.

- More expensive – When buyers have longer payment terms, they often end up paying more for the same house because lenders charge higher interest rates for short-term loans.

- More difficult estate sale process – Selling your home can be more complicated when payments are due every other month rather than annually. This additional paperwork might delay the process and increase costs.

- Higher mortgage risk – The longer the term of your mortgage, the greater your chance of not being able to pay it off in full on time if something unexpected happens (like an unemployment check bouncing). Short-term mortgages also carry higher risks because they aren’t backed by as much collateral as long-term loans.

- Difficulty budgeting down payments – You need to have a very high income or extremely low debt ratios to make a 20% down-payment on a $300k purchase to make a 20% down-payment on a $ 300k purchase to use standard repayment schemes like monthly principal+interest. In these cases, lump sum payments might be required instead

How to calculate payment due date under net 30 day payment terms

Under net 30 day payment, the payment due date is the last day of the month minus 30 days. This means that the due date for a bill will always be at least 31 days after it was issued, even if it falls on a weekend or holiday.

The payment due date can be changed by contacting customer service. If your billing cycle begins on a Sunday and you’d like to change your payment due date to Saturday so that your bills are all paid on Friday rather than Monday, you would call customer service and ask them to change your payment due date field from “Saturday” to “Friday.”

Read Also: Invoice Payment Terms 14 Days

Common practices associated with net 30 day payment terms

When you agree to pay by a certain date, you must understand the common practices associated with net 30 day payment. Payment reminders and follow-ups are critical to ensure that your customers receive the money they owe on time. Late payment fees and interest charges can devastate your business, so make sure to avoid them at all costs.

This time frame should also handle invoicing and billing; invoice as soon as possible after an event (or when you know the amount of revenue generated) rather than waiting until the end of the month or quarter. This way, you won’t run into problems if there are any discrepancies between what was billed and what was received. And finally, always make it easy for your customers to pay their bills – offer online bill pay options or set up automatic payments through your company’s bank account.

Conclusion

Thank you for reading! In this blog, we discussed the important topic of net 30 day payment terms. We explained what they are, how they work, and why they are such an important part of doing business today. We also provided reasons why you should take advantage of these terms and tips for making the most out of them. We hope that you found this article helpful and that it made the decision to go with net 30 day payment terms easier for you. Thanks again!