VAT invoice template, or Value-Added Tax, is a special kind of tax. It’s added to the price of things you buy and services you use. If you have a business or work for yourself, you need to be very careful about how you handle this tax. You need to make special bills called VAT invoices. These invoices show how much tax is being charged. We have a guide here to help you understand all about VAT Invoice Templates.

What is a VAT Invoice Template?

A VAT Invoice Template is like a helper for making your VAT bills. It’s a form that’s already set up to help you put in all the information correctly. This form is different from regular billing forms because it has special areas to show the tax rate and how much tax is being charged. It is really important if you want to get some of that tax money back or if the person buying from you needs to know they paid the tax.

By using this special form, you make sure you’re doing everything the right way for taxes. It’s good for your business, and it’s good for anyone who buys from you.

Why Use a VAT Invoice Template?

Advantages

- Transparency: A VAT Invoice Template helps you put all the important details in one place. It makes everything clear for you and the person you are selling to.

- Accuracy: The template helps you figure out the tax part correctly. It is very important when it’s time to report taxes.

- Legal Compliance: Using a VAT Invoice Template makes sure you are doing everything by the law. It helps you avoid any trouble later on.

Types of VAT Invoices

There are generally three types of VAT invoices:

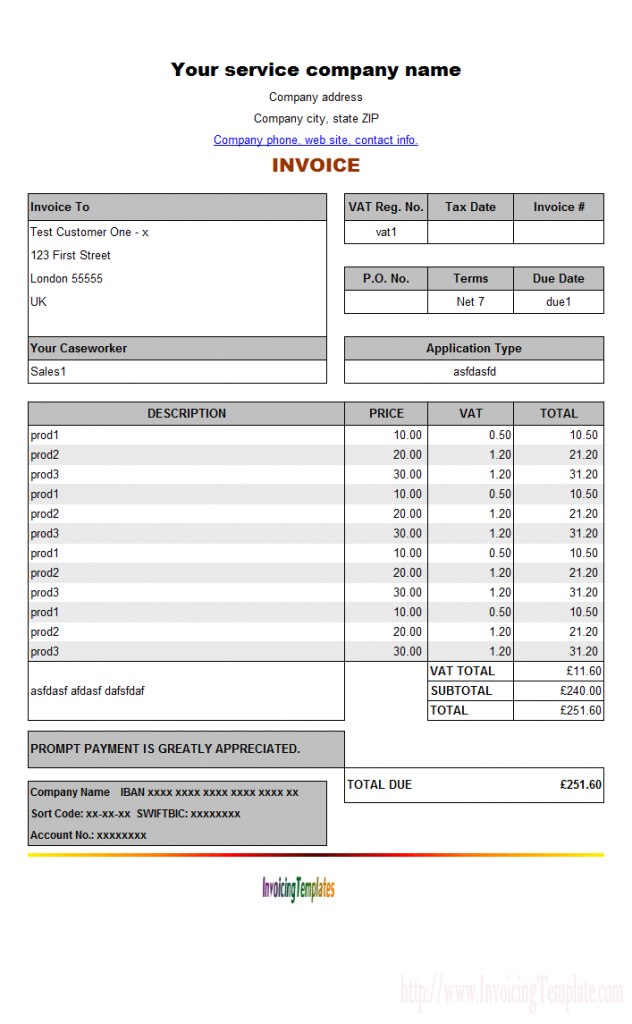

Full VAT Invoices

- These are detailed invoices that include all the information required by tax authorities.

Simplified VAT Invoices

- These are used for retail supplies or amounts less than a specified limit. They contain less detail than full VAT invoices.

Modified VAT Invoices

- These are used for retail supplies over a specified amount and contain details similar to both full and simplified invoices.

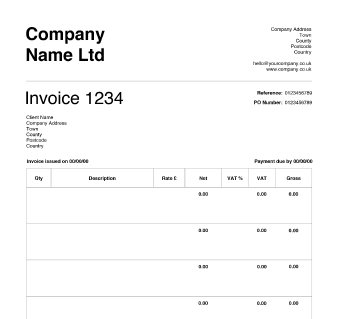

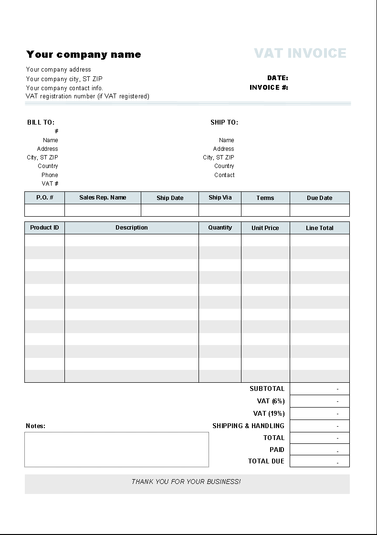

Key Features of a VAT Invoice Template

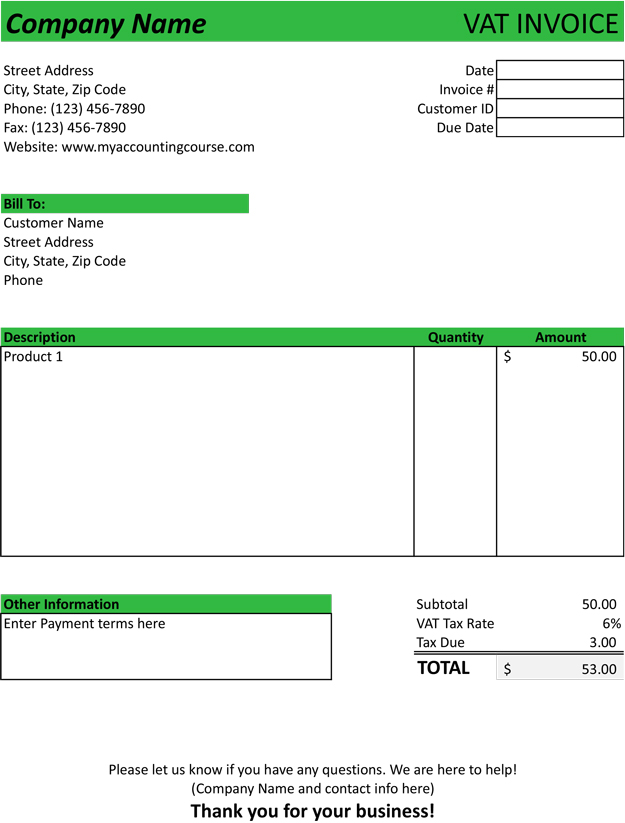

A comprehensive VAT Invoice Template should include the following:

Seller and Buyer Information

- Name, address, and contact details for both parties.

Description of Goods or Services

- Detailed list of the goods or services provided.

VAT Rate and Amount

- The rate of VAT charged and the total amount of VAT.

Total Price Before and After VAT

- The total amount payable without VAT and the total including VAT.

Payment Terms

- Details like due date, early payment discounts, or late fees.

How to Make a VAT Invoice Using a Special Template

Making a VAT invoice is easy if you use a special template called a VAT Invoice Template. Here’s how to do it, step by step:

Step 1: Get the Template

First, find a template that you like. Many websites offer free templates you can use. Pick one that fits what you need.

Step 2: Fill in Names and Addresses

Write down the name, address, and phone number of you and the person you’re selling to.

Step 3: List What You’re Selling

Write down each thing you’re selling or the service you’re providing. Also, write down how much it costs before adding the tax.

Step 4: Add the Tax

You need to show how much tax is being added. To do this, write down the tax rate and then figure out how much the tax amount will be in money.

Step 5: Talk About Payment

Explain how and when you want to be paid. If you give a discount for paying early or charge extra for paying late, mention that here.

Step 6: Check and Send

Before you send the invoice, make sure all the information is correct. Double-check everything to make sure it’s accurate.

Common Mistakes to Avoid

- Incomplete Fields: Always ensure that you’ve filled in all the necessary fields. Missing information can lead to complications in tax reporting and legal compliance.

- Incorrect VAT Calculations: Always double-check your calculations to avoid errors that could result in penalties.

- Not Updating the Template: VAT rates and regulations can change. Make sure your template is updated accordingly.

Benefits of Using a Digital VAT Invoice Template

Digital VAT Invoice Templates have several advantages:

- Convenience: Digital templates are easy to fill out, send, and store.

- Record-Keeping: Storing digital invoices makes it easier to keep track of your transactions for tax purposes.

- Eco-Friendly: Digital invoices are a more sustainable choice compared to paper invoices.

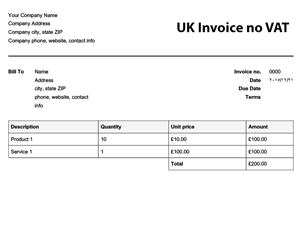

VAT Invoice Template vs. Standard Invoice Template

Both VAT and regular invoice forms are important papers that help you sell stuff. They tell the buyer what they’re getting and how much it costs. But they have some differences, especially when it comes to taxes.

What Sets Them Apart?

The big thing that sets them apart is how they deal with a special tax called VAT or Value-Added Tax. Here’s how:

- Tax Details: A VAT invoice form must show two special things about this tax:

- Tax Rate: This tells you what percentage of the price is tax.

- Tax Amount: This tells you how much tax you actually have to pay in money.

Why It’s Important

Showing the tax details is more than just extra work. It’s important for several reasons:

- Clear Information: It helps everyone know exactly how much tax is being added. It makes it easy to understand the total cost.

- Following the Law: In many places, you have to show these details to follow the tax laws.

- Getting Tax Back: Sometimes, businesses can get some of the tax money back. The VAT invoice form helps with that.

Ease of Use: Regular invoice forms are usually simpler because they don’t have to show all this tax stuff. But remember, simpler doesn’t always mean better. If you need to show the tax, then a VAT invoice form is what you should use.

FAQs About VAT Invoice Templates

Do I Have to Use This Special Form?

No, you don’t have to. But it’s a good idea because it helps you follow the rules and makes your job easier.

Is It Hard to Use This Form?

No, it’s not hard. The form tells you what to write and where to write it, so it’s easy to use.

Is the Form Free?

Many websites offer free forms you can download. Some places might have forms with extra features that cost money.

Can I Use the Computer to Fill It Out?

Yes, you can use a computer to fill out this form. Some people also use paper, but a computer form is easier to fix if you make a mistake.

Should I Keep a Copy?

Yes, it’s a good idea to keep a copy. It helps you remember what was on the bill and is good to have in case there are any questions later.

If you have a business, you should charge a special tax called VAT. Making sure your VAT bills are correct is very important. A special form called a VAT Invoice Template can help you do this easily.

This form makes sure you include all the things you need to. You can use a paper form or a computer form, but it’s important to pick the one that follows the rules and works for your business.

So, the next time you need to make a VAT bill, use this special form. It helps you do everything right and makes the job easier.